A Holiday Season Like No Other

How the Global Supply Chain will Flip the Holiday Season on its Head

The Current Landscape

As major supply lines continue at a snails pace, sales floors nationwide are becoming leaner as retailers stretch merchandise further. With the rising costs of international shipping, many companies are beginning to slowly introduce gradual price increases to cover their margin. The current consumer inflation for commodities less food or energy was 8.7% YoY1 and secondary markets have become major economic sectors, diverting large volume sales potential from major companies.

In May ‘21, the Fed released the current inventory to sales ratio for total US retail. As a nation we have just north of 1 month of inventory to supply retail demand, an all time low dating back to 1992.2 With the continued strain on global supply chains, it is unlikely that we will be able to provide the relative stock to cover the red hot demand in the consumer markets come holiday season.

The Retail Inventory to Sales Ratio shows the relationship of ending inventory to that month’s sales. For example, a ratio of 2.5 would indicate that the retail stores have enough merchandise on hand to cover two and a half months of sales.

Painting the Picture

Global supply chains are built on predictable demand patterns that ebb and flow throughout any given year. What we are are currently experiencing is red hot import and manufacturing demand that is stretching the global supply chain to its limits. This is creating massive shipping delays, production shortages, increasing inflationary events and retail inventory issues that are causing bare sales floors and delayed product releases.

What we are currently experiencing in 2021 is a supply hangover that began with an unprecedented halt in economic production that wiped out more than $2.1 trillion in GDP during Q2 2020 (-33.3% vs previous quarter).3 Since the onset of the COVID shelter in place mandates, manufacturing demand has picked up substantially.

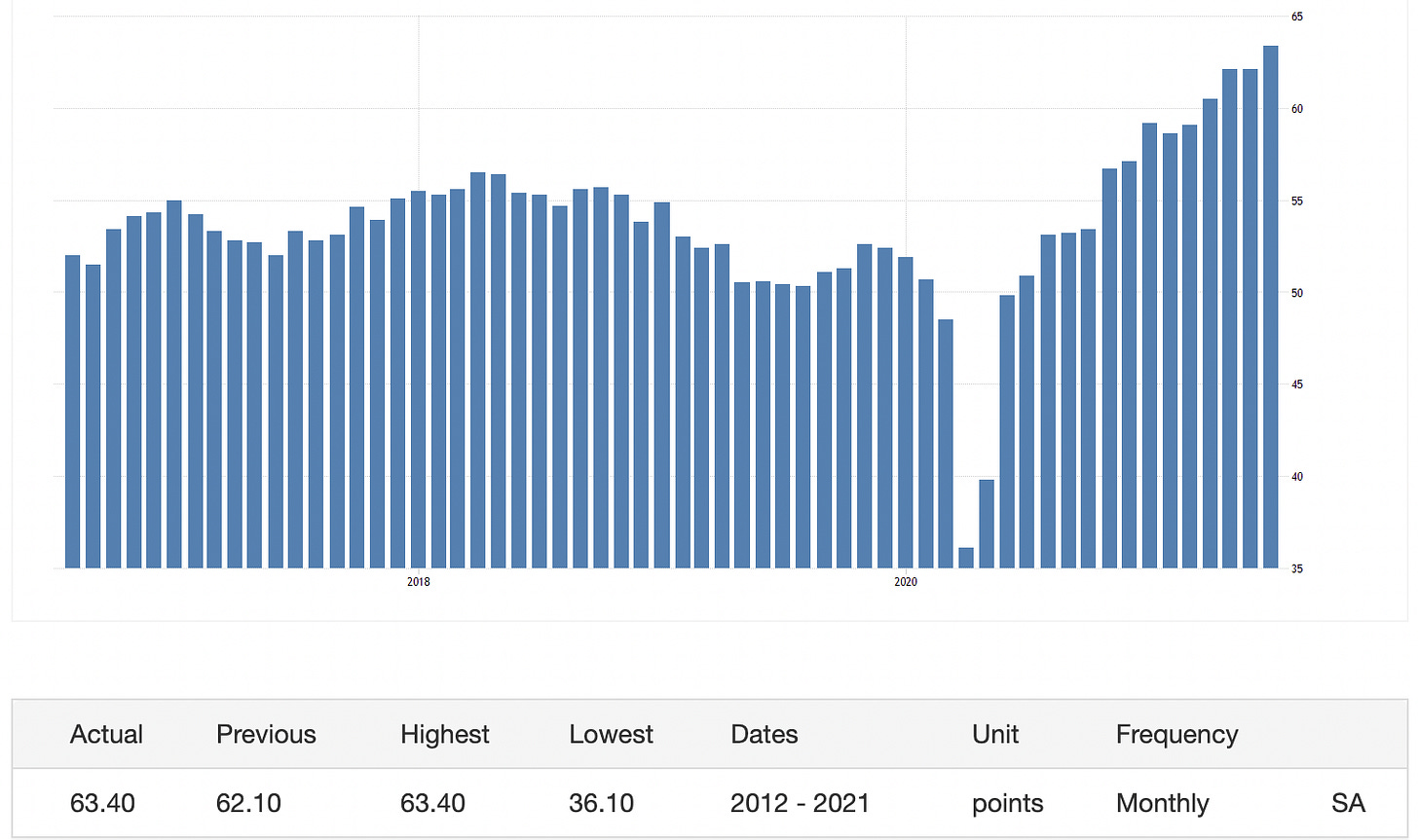

Above is the IHS Markit US Manufacturing demand PMI. It is based on five major survey areas: new orders, inventory levels, production, supplier deliveries, and employment.4 In the early months of 2020, you can see a complete collapse in manufacturing demand, dropping 34% vs 2 year average. As of July 2021, we hit an all time high for manufacturing demand (8 years of history).

A Game of Catch Up

With help from social safety nets, stimulus checks and pent up pressure much akin to the “roaring ‘20s”, the US economy is seeing sky high consumer demand. This American exuberance has become the proving grounds for the global supply chain as we test adaptability and profitability.

Current Challenges:

Supply imbalances lead to longer production lead times (52 week lead time for certain electronic components up from 16 weeks a year ago.)5

The average oversea shipping costs of a 40 foot long container is $10,174, a 466% increase YoY6.

US freight costs by truck increased by 15% YoY.7

39% of shipping containers arriving into a US port were on time in May,8 and total ships late by a week or more accounted in Jan- May ‘21 made up almost half of all late ships between 2012 - 2020.9

A Christmas Like No Other

With another wave of COVID quickly reestablishing itself as the main challenge in today’s global society, it would be hard to project a less turbulent Q4 ‘21 into Q1 ‘22. Manufacturing may slow as less developed countries weigh the benefits of quarantining vs output.

In a season driven by large inventory volume and deeper price cuts, we will be in a very unfamiliar landscape. Stock shortages will very likely continue if not worsen as holiday demand ramps up. To protect against larger shipping costs, category specific inflation will increase as companies try to protect their margins.

Delivery of merchandise will also become an interesting side story for the holidays as supply chain delays will funnel unseasonable merchandise onto sales floors and peak merchandise may miss entirely.

An inventory shortage coupled with a strong inflationary moment will make for an interesting Black Friday across the retail sector.